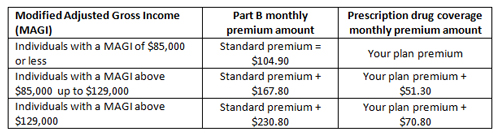

Each year the Social Security Administration (SSA) notifies Medicare participants of their annual Medicare premiums. Some people are surprised when their premiums increase. Understanding how your income impacts your premiums can minimize that surprise. Higher-income beneficiaries pay higher premiums for Part B and prescription drug coverage.

Individuals earning above $85,000 and married couples earning more than $170,000 are required to pay higher premiums for Medicare Part B and Part D. The federal government looks at modified adjusted gross income (MAGI) in the latest tax returns filed with the Internal Revenue Service (typically two years back) to determine the premiums. So, for 2016 premiums, the 2014 tax returns will be used. In general terms, modified adjusted gross income is your total adjusted gross income and tax-exempt interest income.

The income-related premium increases come in four increments as illustrated below:

If you’re married and lived with your spouse at some time during the taxable year, but filed a separate tax return, the following chart applies to you:

You should promptly notify the SSA of any life changing event. Life changing events include death of a spouse, marriage, divorce, job loss or reduced hours, losing pension benefits, etc… If your income has decreased because of a life-changing event, the SSA can reduce the amount of your premium.

You should also notify the SSA if you amended your tax return and it changes the income that the SSA used to determine the premiums.

One way to avoid higher premiums is to manage your MAGI under the threshold amounts noted in the illustration. For example, if you sell capital gain property, you might consider collecting the proceeds on an installment basis over a number of years instead of receiving the payment all in one year. For most taxpayers, the gain is recognized as the cash is received. The installment method would keep your annual income lower. Consult with a Kruggel Lawton tax advisor for strategies on managing your income.

Medicare beneficiaries should review their yearly premium notices carefully. If you disagree with the decision about your income-related adjustment amounts, you have the right to appeal. You can find the appeal form online at www.socialsecurity.gov/forms/ or request a copy by calling 1-800-772-1213.

Shaun Mawhorter, CPA

Shaun Mawhorter, CPA

Senior Manager

Email Me

574.264.2247, x303